How investing with LCM works

Larson Capital Management offers a seamless online platform that gives you the insights you need to make informed real estate investment decisions and track your progress with ease.

Invest with Larson Capital Management

LCM provides investors with the resources they need to become better informed, empowered real estate investors. Since our founding, the LCM team has created & managed over 50 funds, raising over $2.1 billion in investment capital.

Ready to get started? Click here to create your free account or follow the below steps:

How It Works

Larson Capital Management provides investors with a simple way to build a stronger, more diversified portfolio.

1. Setup an Account

Register for our online platform by setting up a free account.

2. Research Deals

Investors are presented with information through our online platform.

3. Verify Accreditation Status

Only accredited investors are able to invest in our investment strategies. Accreditation status is set by the SEC and verified by our partner, Parallel Markets.

4. Invest Directly

Click “invest” when you’re ready to begin the process.

1. Setup an Account

Register for our online investment platform.

Effortless Setup:

Follow a step-by-step path to register your account and begin viewing investment opportunities.

Award-Winning Platform:

Our technology partner is an award-winning technology platform that anticipates the needs of customers.

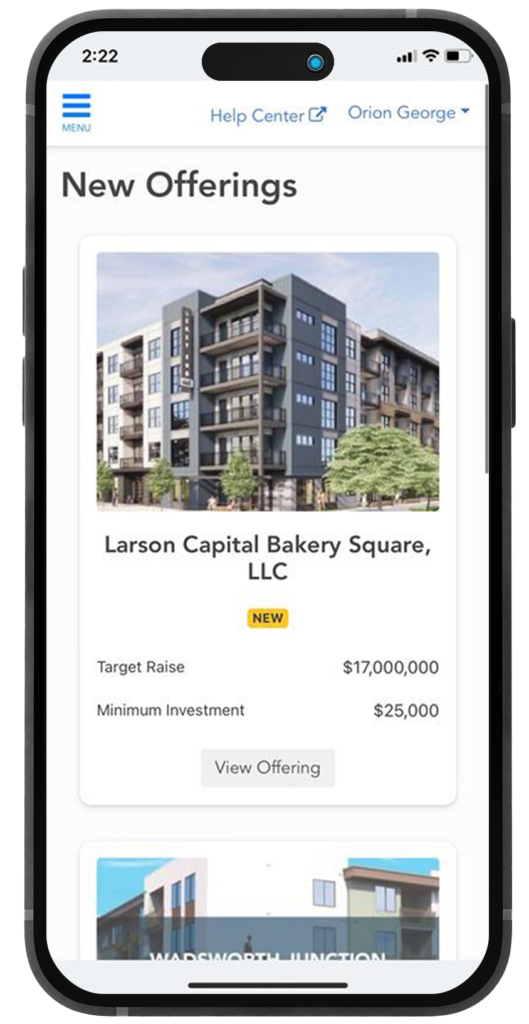

2. Research Deals

Explore investment opportunities

Alternative Investment:

We offer alternative asset classes that may hedge you from certain risks by diversifying your investment portfolio.

Highly-vetted:

All investments pass a seven-step due diligence process.

3. Verify Accreditation Status

Secure third-party accreditation verification

Income Requirement:

Earned more than $200,000 individually (or $300,000 with a spouse or spousal equivalent) in each of the last two years, with an expectation of maintaining that income level.

Net Worth Requirement:

Has a net worth of over $1 million, either individually or jointly with a spouse, excluding the value of their primary residence.

4. Invest Directly

Invest with confidence on our online real estate investment platform

Ease of Use:

Easily and securely send funds to complete your investment.

Dedicated support:

Our investor relations team is available to answer your questions at any time.

Learn about our strategies

LCM targets investments in institutional-grade, income producing commercial property, focusing on multifamily development, commercial office, and industrial property types.

How does LCM review strategies?

Every strategy in LCM’s offering undergoes a 7-step investment screening process. Only highly vetted real estate investment strategies are presented to our investors. LCM’s experienced team of real estate professionals conducts extensive due diligence before offering an investment opportunity to investors.

What strategies are in the LCM portfolio?

Our platform offers a variety of deals, each offering its own unique risk and return profile based on the individual business plan. Read more about each property on our property pages.

What information is provided about deals?

To help you make informed decisions, we provide in-depth information and insights for each deal, including presentations and webinars, key deal assumptions and risks, details on the business plan and financials, return structures, and much more.

Compare Investment Options

Investing in commercial real estate can be a part of building a healthy portfolio. But there isn’t a one-size-fits-all way to invest. Larson Capital Management has created a simple path that makes it easy to find the right strategy that fits your unique needs.

Individual Property

Invest directly in individual real estate opportunities.

Concentrated Risk but Potential for Higher Returns.

Your investment depends on a single property’s performance, leading to higher risk but also the possibility of greater returns if managed well.

Build a Custom Portfolio.

Curate a tailored real estate portfolio by selecting individual deals that support your unique investing objectives.

Diversified Fund

Invest in several properties in a single investment.

More Stable but Potentially Lower Returns.

Returns are typically more predictable due to diversification, but they may not be as high as a well-managed individual property investment.

Get more with one investment.

Funds typically require a minimum investment similar to individual deals, yet offer exposure to multiple projects, helping potentially diversify your investment.

Not sure where to start? We’re standing by to help

Our dedicated Investor Relations Team is standing by to help simplify your real estate investing process.