Your Investment Will

Shape Tomorrow

Is Your Portfolio Truly Diversified? See how private markets can add depth and strength to your investment mix.

$2.1B+

in acquisitions completed

4200+

multifamily units built or under development

1800+

investors served

*as of 3/13/2025

LCM Direct Investing – A Decade of Experience

Whether you’re focused on preserving wealth, creating a meaningful legacy, or simply investing with greater purpose, Larson Capital provides a streamlined platform and dedicated support team to help you move forward with clarity. Explore opportunities at your own pace, knowing you’re supported by a firm that values relationships, stewardship, and your vision for the future.

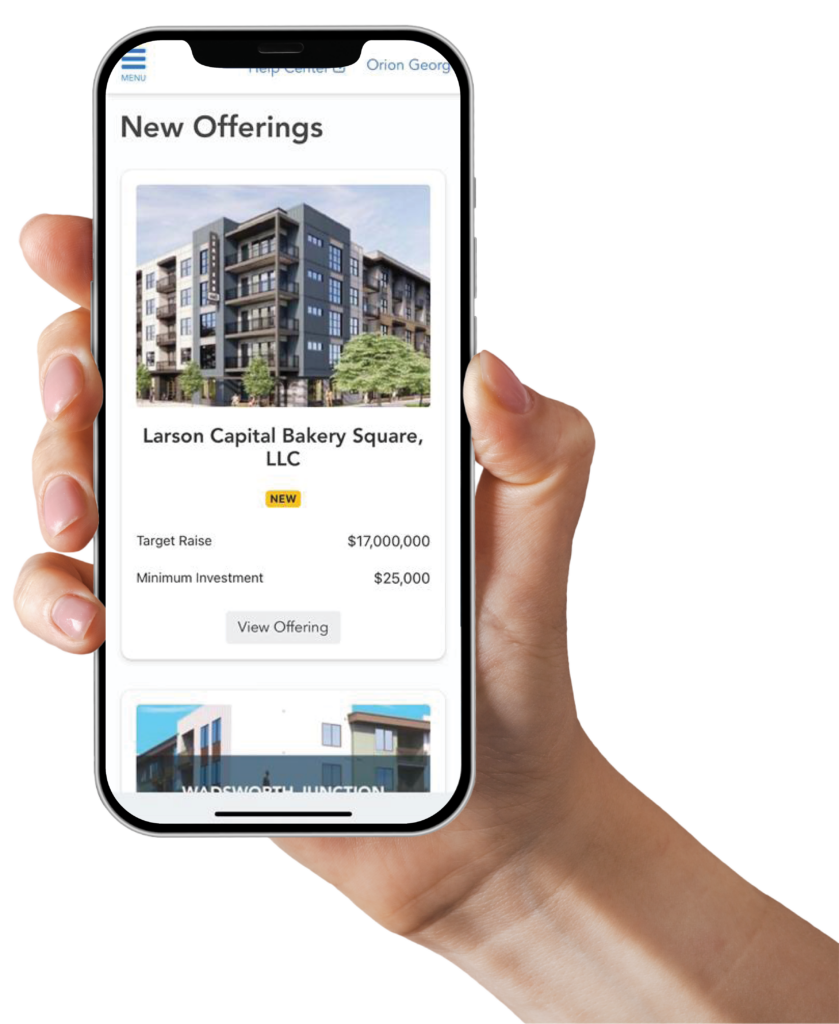

How Investing with Larson Capital Management (LCM) Works

LCM targets investments in institutional-grade, income producing commercial property, focusing on multifamily development, commercial office, and industrial property types. Using our platform, investors can easily review, invest, and manage their personal real estate portfolio.

Verify

Status

Accreditation status

verified by our partner, Parallel Markets

Research

Deals

Investors are presented

with information through our online platform.

Invest

Directly

Click “invest” when you’re ready to begin the process

Current Strategies

Ever and Verve

College Station Student Housing Development

COLLEGE STATION, TX | 568-UNIT, 1,738-BED STUDENT HOUSING DEVELOPMENT

Minimum

Investment

$25K

Equity

Required

$108M

Projected

Exit

Phase 1: Year 3

Phase 2: Year 4

Larson Capital Real Estate Fund III

Diversification Investment Strategy

For investors seeking a diversified portfolio of commercial real estate assets.

Minimum

Investment

$25K

Target

Fund Size

$50M

Larson Income Fund II, LLC

Preferred Equity Investment Strategy

For investors seeking cashflow and diversification.

Minimum

Investment

$25K

Target

Fund Size

$50M

It’s time to

invest direct

Larson Capital Management (LCM) is

a private real estate investment firm with a diverse offering of equity and

debt investments.

Our primary goal is to acquire and develop real estate investments as an alternative investment solution for our investors. To accomplish this, we target premium quality properties in high growth, secondary, and tertiary markets throughout the United States, including opportunity zones.

We pride ourselves on our ability to be nimble and investor-focused, which enables us to find creative solutions when structuring deals.

Relationship-Based Deal Flow

Our extensive relationship with developers, brokers, and other industry partners gives us access to top-quality opportunities.

Targeted Search Criteria

We specifically look for opportunities in high-growth secondary and tertiary markets with barriers to entry that will give us an advantage.

Structured Decision-Making

Our investment committee, comprised of seasoned industry experts, thoroughly evaluates and votes on each investment opportunity before offering to investors.

INTRODUCING

Direct to Consumer

Real Estate Investment

On-Demand Investing:

Our platform allows you to invest directly, giving you access to top-tier real estate opportunities from the comfort of your home or on the go.

Our Portfolio of Current & Sold Properties

Each property in our portfolio has been selected with the goal of producing optimal returns for our investors. We seek to invest in properties that have stable tenant history with tenants from across different industries and markets to maximize tenant diversification.

Explore some of our properties below.

Recently Completed Projects

Delmar Loop Mixed-Use Development

Visit Property Page >

Edge@BRDG

Visit Property Page >

City Place East

Visit Property Page >

Corporate Lake

Visit Property Page >

Broadway Tower

Visit Property Page >

The Reeve

Visit Property Page >

Norwood

Visit Property Page >

Lincoln Legacy II

Visit Property Page >

Custer Court

Visit Property Page >

Wadsworth Junction

Visit Property Page >

Departure Flats

Visit Property Page >

The Montage at Hawk Ridge

Visit Property Page >

Flats on Felty

Visit Property Page >

Hambright Junction

Visit Property Page >

Statesville

Visit Property Page >

701 E. Hill

Visit Property Page >

The Avery

Visit Property Page >

The Rockwell

Visit Property Page >

Plaza at Legacy

Visit Property Page >

The Statler

Visit Property Page >

Somerset

Visit Property Page >

The Levy at Martini Corner

Visit Property Page >

Treetops

Visit Property Page >

Tollway Towers

Visit Property Page >

5th & Lincoln

Visit Property Page >

40 West

Visit Property Page >

The Nines

Visit Property Page >

5555 Winghaven

Visit Property Page >

Sharon Road

Visit Property Page >

Woods Mill Pointe

Visit Property Page >

Silver Star

Visit Property Page >

Rider Trail

Visit Property Page >

Edge @ West

Visit Property Page >

Crest Ridge

Visit Property Page >

Crown Plaza

Visit Property Page >

Pointe 70

Visit Property Page >

Granite Tower

Visit Property Page >

West Park II

Visit Property Page >

West Park I

Visit Property Page >

Legacy Center

Visit Property Page >

Pine View Pointe

Visit Property Page >

Herriman Corner I & II

Visit Property Page >

NorthPark Business Center

Visit Property Page >

One Rider Trail

Visit Property Page >

South County Medical Building

Visit Property Page >

The Wolf

Visit Property Page >

The Oliver

Visit Property Page >

The Montage at Lee’s Summit

Visit Property Page >

Larson Capital Real Estate Fund I/IQ

Visit Property Page >

Banner at Sterling Farms

Visit Property Page >

Reno Ave

Visit Property Page >

Ready to start investing?

Most Common FAQs

What is Larson Capital Management and why should I use it to invest in real estate?

Larson Capital Management (LCM) is a private real estate investment firm with a diverse offering of equity and debt investments. We pride ourselves on our ability to be nimble and investor-focused, which enables us to find creative solutions when structuring deals. To date, LCM’s 1800+ investors have participated in over $2 billion in commercial real estate acquisitions.

Our primary goal is to acquire and develop real estate investments as an alternative investment solution for our investors. To accomplish this, we target premium quality properties in high growth, secondary, and tertiary markets throughout the United States, including opportunity zones.

How it Works: We simplify access to institutional-quality real estate by offering a streamlined, online investing experience tailored for accredited investors. Through our secure platform, you can browse offerings, complete paperwork digitally, and monitor your portfolio—all in one place. Each opportunity is backed by rigorous in-house due diligence and active asset management, ensuring alignment with your investment goals.

Our approach prioritizes transparency, consistent communication, and high-quality deal flow across a range of property types and markets. Whether you’re diversifying or building long-term passive income, we make investing in real estate accessible, efficient, and investor-first.

I want to get in contact with someone at Larson Capital Management. Who should I contact?

We take pride in offering personalized service and support to every investor. Whether you’re exploring your first opportunity or managing a diverse real estate portfolio, our team is here to help. For questions or assistance, please contact us by phone (314) 787-7226, email, or through the contact form on our website. Our investor relations team is committed to providing timely responses and ensuring a smooth experience at every step of your journey with Larson Capital Management.

Will my investment by safe with Larson Capital Management?

Our Investments Team brings extensive experience in commercial real estate, having participated in billions of dollars’ worth of transactions across diverse asset classes. Each opportunity undergoes thorough underwriting to ensure strong potential for risk-adjusted returns, and we structure deals with investor protection at the forefront.

Once you invest, our Asset Management Team actively monitors performance and works to optimize outcomes throughout the entire lifecycle of the asset. Investors receive regular updates and reports to stay informed on project progress and financial performance.

Your data security is also a top priority. Our platform uses robust digital safeguards and industry-standard encryption protocols to protect your personal and financial information.

At Larson Capital Management, transparency and client care are at the core of everything we do. Whether you have a question about an offering or want to dive deeper into an investment strategy, our team is here to support you every step of the way.

Investment advisory services are provided by Larson Capital Management, LLC, an investment advisor registered with the Securities and Exchange Commission (SEC). All securities involve risk and may result in significant losses. Investing in private placements also requires long-term commitments. Investors should have the ability to afford to lose the entire investment and the should have low liquidity needs. Further, alternative investments and private placements should only be a part of your overall investment portfolio and the alternative investment and private placement portion of your portfolio should include a balance of different underlying investment strategies. Before investing you should: (1) conduct your own investigation and analysis; (2) carefully consider the investment and all related charges, expenses, uncertainties, conflicts-of-interest and other risks described in the offering materials; and (3) consult with your own investment, tax, financial and legal advisers. Past performance is no guarantee of future results. Any financial projections or returns shown on the website are estimated projections of performance only, are hypothetical, are not based on actual investment results and are not guarantees of future results. Target projections do not represent or guarantee the actual results of any transaction, and no representation is made that any transaction will, or is likely to, achieve the results or profits similar to those shown. In addition, other financial metrics and calculations (including amounts of principal and interest repaid) shown on the website or other publicly available mediums have not been independently verified or audited and may differ from the actual financial metrics and calculations for any investment. Private placement investments are not bank deposits and, thus, they are not insured by the FDIC or by any other federal governmental agency. Further, they are not guaranteed by Larson Capital Management, LLC, its affiliates or any other party and they may lose value. Neither the Securities and Exchange Commission (“SEC”) nor any federal or state securities commission or regulatory authority has recommended or approved any investment or the accuracy or completeness of any of the information or materials provided by or through our website or any other medium. Any investment information contained herein has been secured from sources that Larson Capital Management, LLC believe are reliable, but we make not representations or warranties as to the accuracy of such information and accept no liability therefor. Alternative investments provide limited liquidity and include, among other things, the risks inherent in investing in securities and derivatives, using leverage and engaging in short sales. An investment in an alternative investment fund is speculative, and involves substantial risks. An alternative investment fund may be highly leveraged. These funds may not be subject to the same regulatory requirements as mutual funds, and their fees and expenses may be high. Real property investments are subject to varying degrees of risk. The yields available from investments in real estate depend on the amount of income and capital appreciation generated by the related properties. Income and real estate values may also be adversely affected by such factors as applicable laws, interest rate levels and the availability of financing. The performance of the economy in each of the regions in which the real estate owned by the Fund is located will impact the income from such properties and their underlying values. The financial results of major local employers also may have an impact on the cash flow and value of certain properties.

How does Larson Capital Management compare with other investment platforms?

Diverse Investment Opportunities

At Larson Capital Management, we offer a curated selection of institutional-grade investment opportunities, including equity positions and fund offerings across a variety of commercial real estate asset types. Our focus remains on mid-market properties—such as multifamily, office, and industrial assets—in high-growth regions. These investments are strategically selected for their income potential and long-term value, allowing investors to align their portfolios with their specific financial goals.

Proven Expertise

Our leadership team brings decades of real estate investment experience and a disciplined, data-driven approach to deal sourcing, underwriting, and asset management. We pride ourselves on identifying high-quality opportunities and maximizing value through active oversight and operational excellence.

Investor-First Support

Transparency and communication are core to our process. From onboarding to exit, investors receive regular updates and ongoing asset management reports. Our dedicated team is always available to answer questions, provide insights, and ensure every investor feels confident and informed throughout the investment lifecycle.